KING - My e-mini trading results in 2011 - I can do it too!

This section features the fourth year of my day trading results with KING, including 10 full week or even longer periods of results.

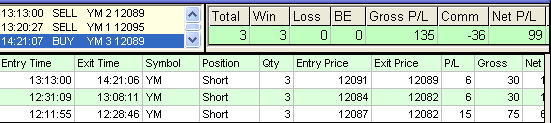

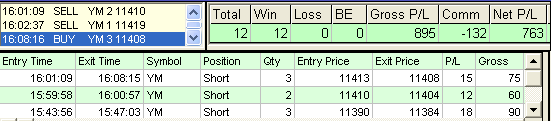

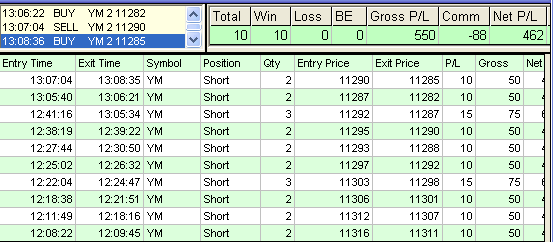

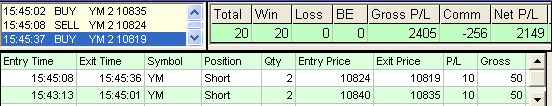

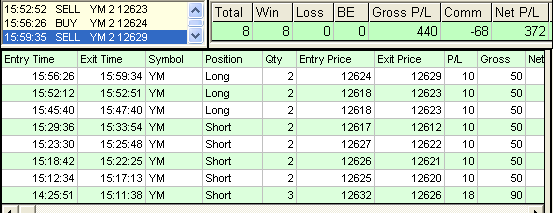

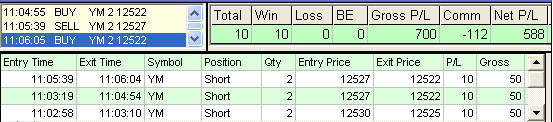

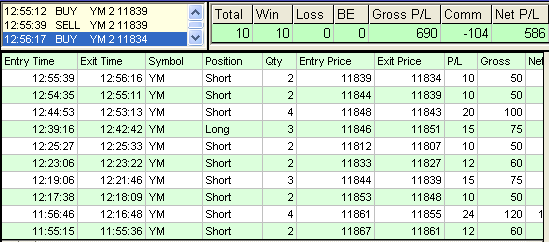

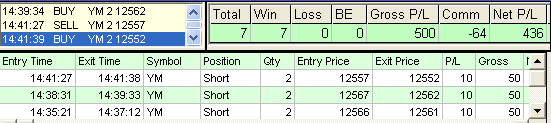

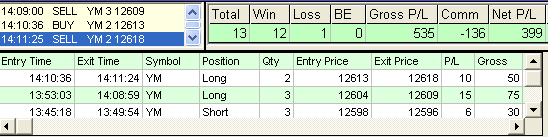

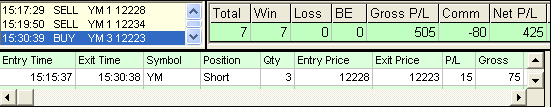

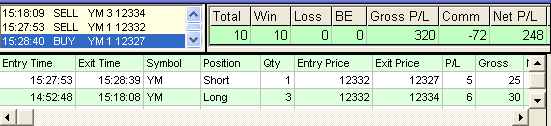

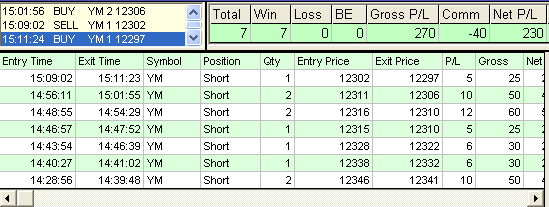

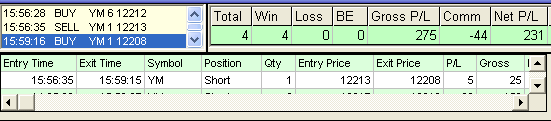

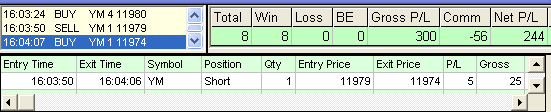

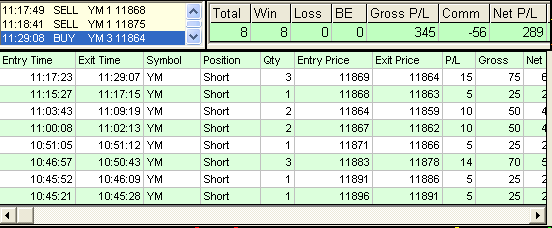

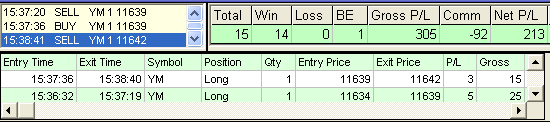

The end of a full week

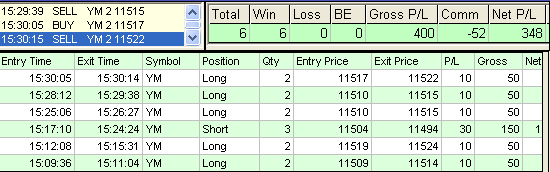

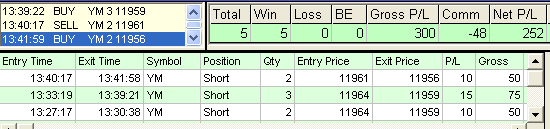

Yep, that was a dreaded Friday, December 9th, and my trading was arduous. I thought that the market had little upside potential and I based it on reading the 5 minute chart. I was right to some extent, but my timing was rather poor and, what's worse, I hesitated to add yet another contract. Adding it would have made things much easier. Alas, I did not do it and had to resort to lowering my target to 2 ticks on two occasions. The last trade lasted over an hour. It was the reason I decided to close the shop for a day. I was not very much in tune with the market and not gutsy enough to stick to my guns and risk yet another contract. Unless I want to make some point, I usually don't show results below $100, as they are not very representative, but this time it's also the last day in a full week, so that's another reason I decided to show this screenshot. Well, not every day you can take 20 flawless trades, some days are more like this one.

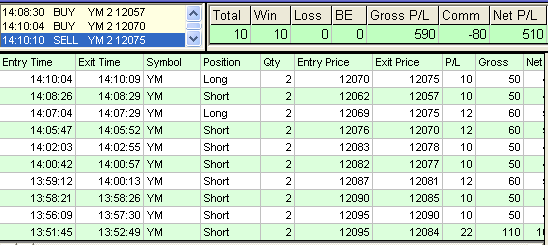

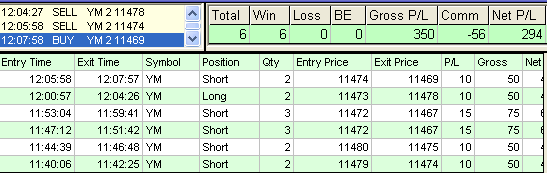

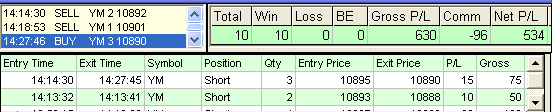

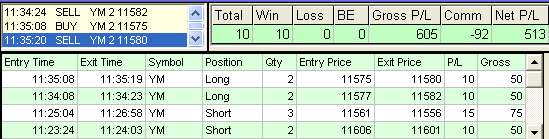

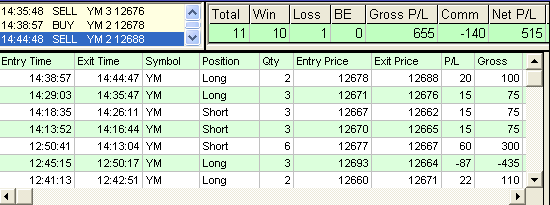

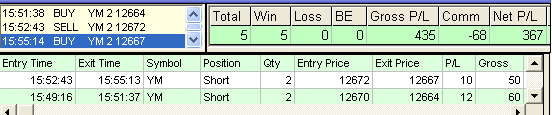

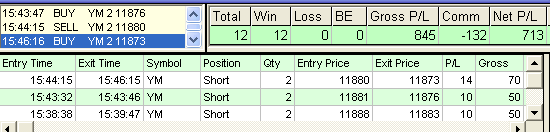

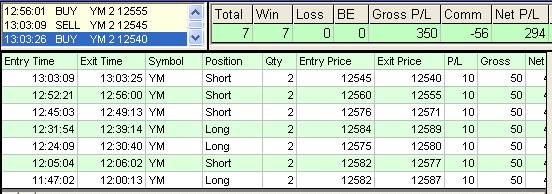

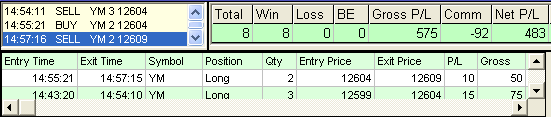

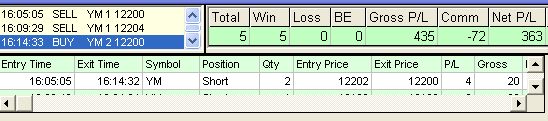

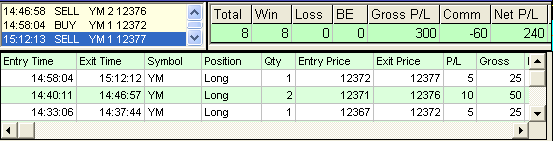

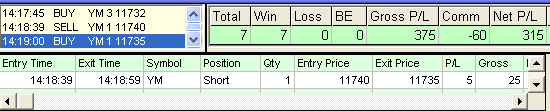

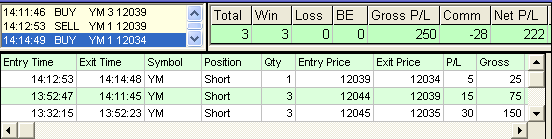

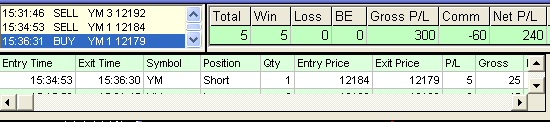

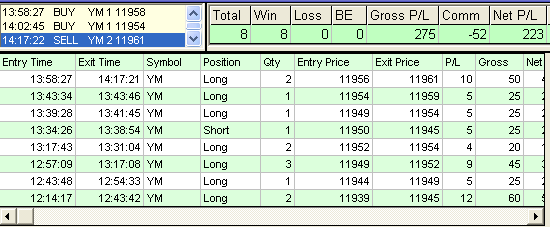

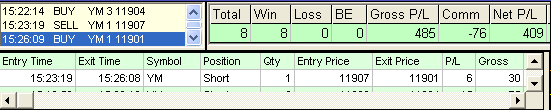

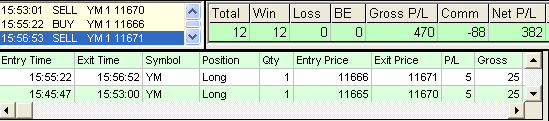

Rollover day

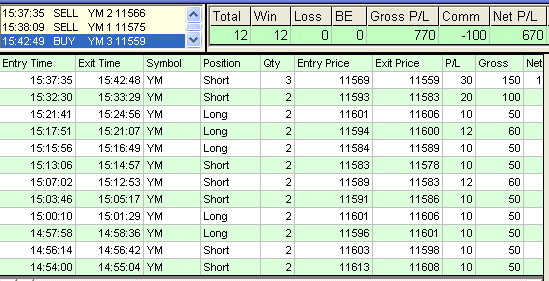

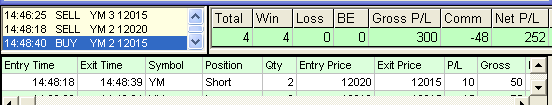

It's Thursday, December 8th, yet another rollover day. I actually started trading with the old contract, forgetting to change the contract in Bracket Trader, but it is rarely ever any problem on the first day of a new contract. I do have a history of forgetting to switch to a forward contract on a rollover day, but today I was able to correct it pretty fast. The last trade was a bit of an underachiever. I lowered my target from the standard 5-10 ticks, in part because Sierra Chart would sometimes lag behind Bracket Trader, which made me a bit anxious, and I definitely did not want to screw up on the last trade. Well, eventually the 5 tick target was hit and even 10 ticks was possible on this trade, so my original judgment was right, just the circumstances were not particularly conducive to execute it as planned. I hope this lagging was just a rollover day event because if it continues tomorrow I may be forced to take fewer trades. Or may even not trade at all.

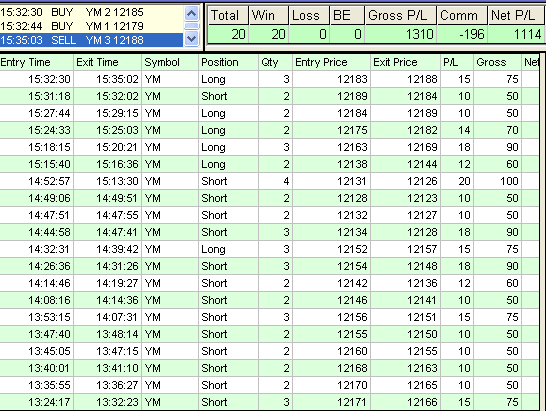

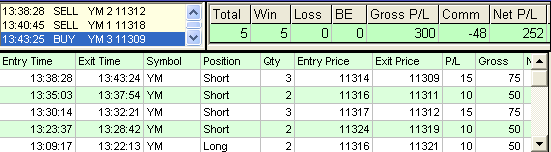

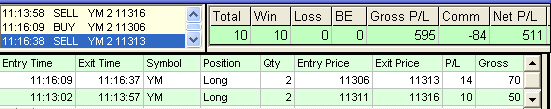

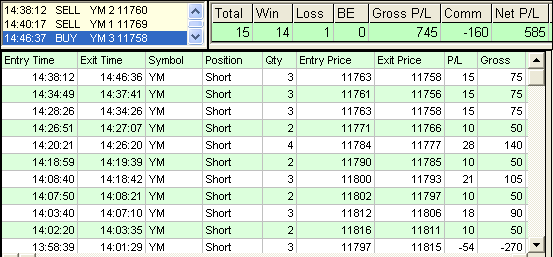

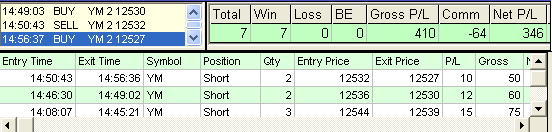

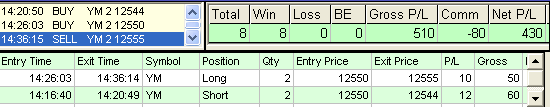

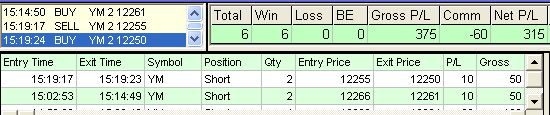

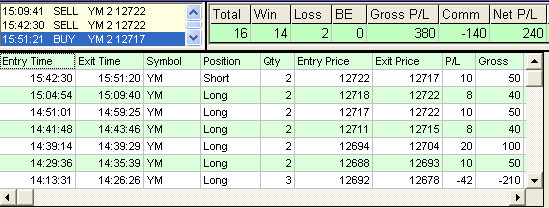

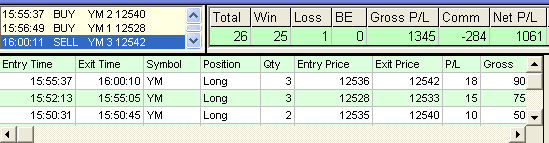

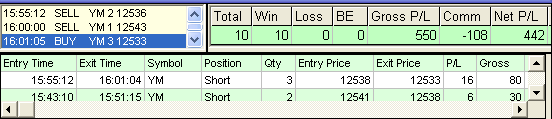

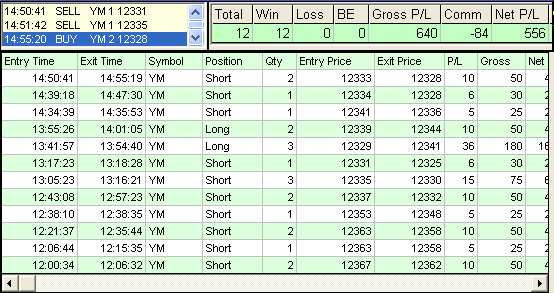

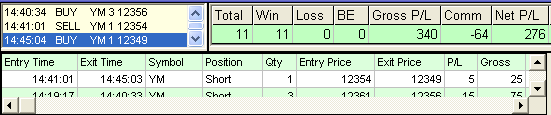

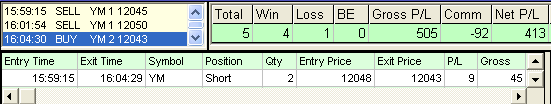

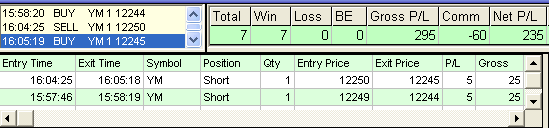

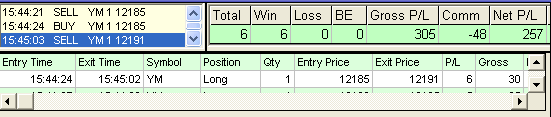

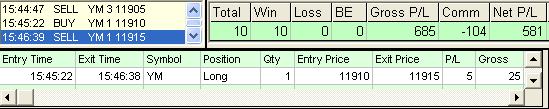

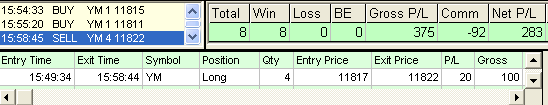

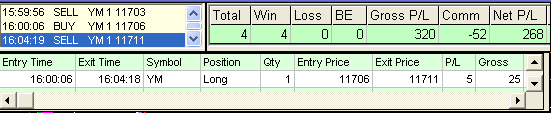

20/20

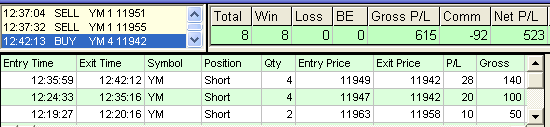

You want more? You got it. I thought I would stop at 10 trades, but then the market moved fast down, so I decided to take advantage of it. And then it moved fast again, this time up, so I took some more trades. That's the memo from the glorious day of December 7th. Tomorrow is a rollover day, so I may not trade unless I see some neat moves.

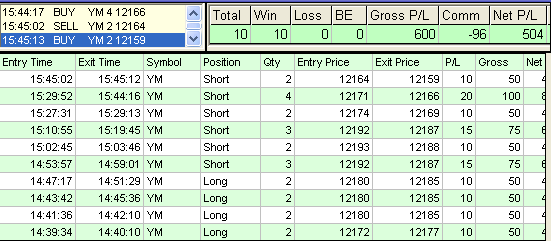

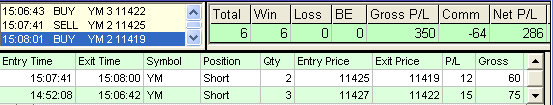

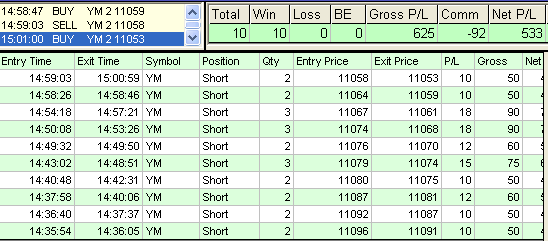

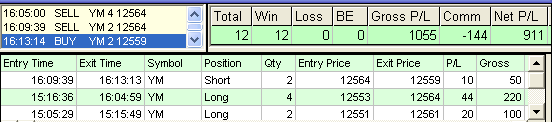

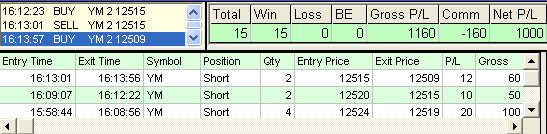

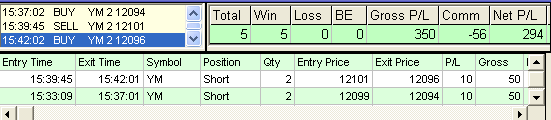

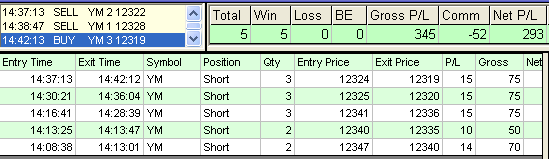

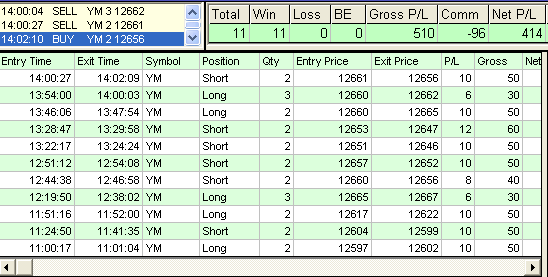

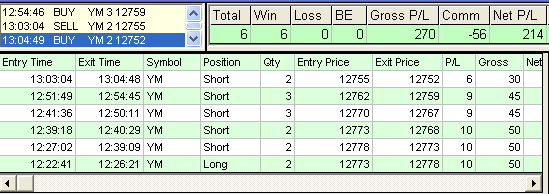

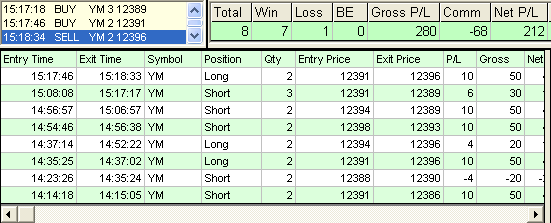

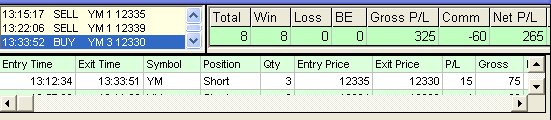

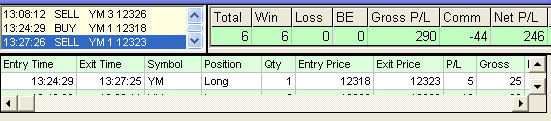

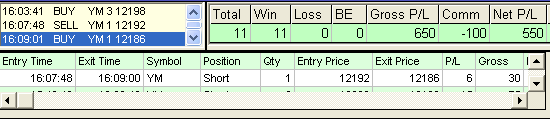

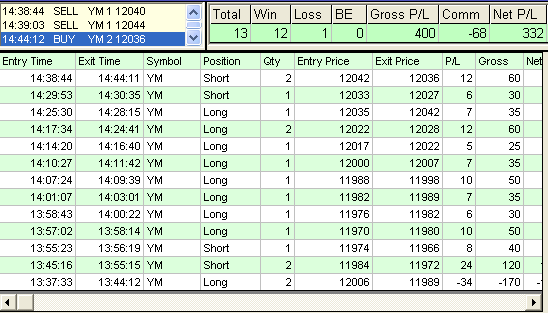

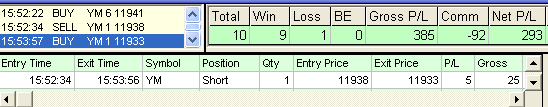

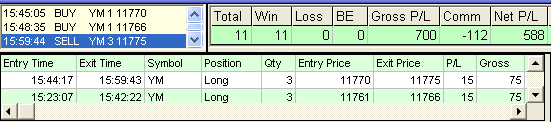

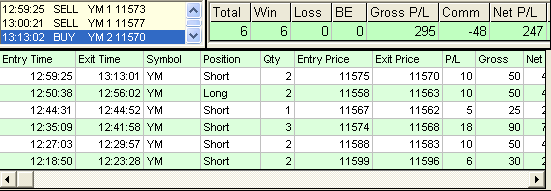

Slower market

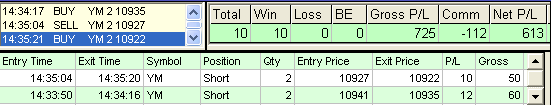

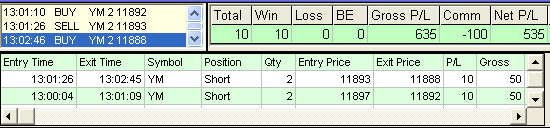

The day after my first attempt following the break was a bit slower, so it took me longer to take 10 trades. I managed to take only 5 trades during the first 20 minutes or so as opposed to 10 yesterday. That's because volatility today was lower, even during the breakouts, like the one I started my trading with. I also had to add to my position a bit when I got stuck in a range. I don't mind that as long as I am on the right side of the market. The entry point is not that critical, what matters more is if you are entering at a right spot and on the right side of the market. That's the memo from Tuesday, December, 6th.

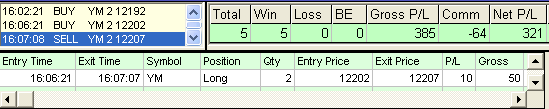

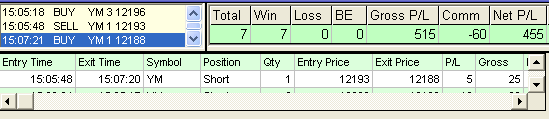

Good timing...

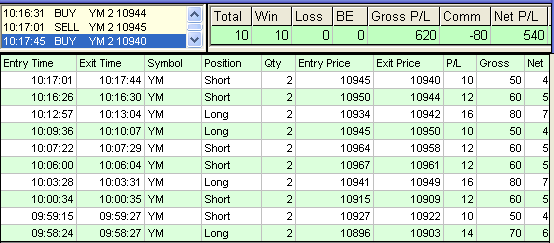

The first attempt after my recent surgery. I chose the right time when the market dropped sharply leading to increased volatility. As many as 7 out of 10 trades featured here took less than 1 minute, which is not a record, the record being 10 out of 10, but it's still a nice performance. Only about 20 minutes of trading, a bit over $500. Not bad... This happened on Monday, December, 5th.

I have not posted here for a while. The previous post was on October 13th and today is November 23rd. Moreover, I don't expect to be posting here a lot throughout the rest of this year. That's because I am recovering from surgery that I had to undergo in late October and it's very unlikely that I will be trading in earnest before I have completely recovered. There are already well over 260 screenshots in "I can do it too!" section, so it's not like the world still needs a lot more. The full recovery may take until the end of this year, but I am definitely getting stronger and plan to resume selling KING on the weekend that follows this Thanksgiving. If you live in the US, I wish you a very happy Thanksgiving, and please come back for a special KING offer to be unveiled in a few days, whether you live in America or not.

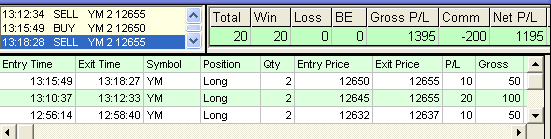

So easy, it's boring...

Another day, October 13th, but not Friday. Friday is tomorrow and if I am trading this Friday, I may post another screenshot.

Another October day, another tight range

Two days later, the 12th. Notice that I was able to generate 30 ticks per contract from a range of merely 20 ticks at the time of my trading. This is pretty similar to what I was able to do last time when I generated 25 ticks per contract from a range a bit smaller than 20 ticks, if I recall it correctly, but with 5 trades only. As you see, you can do pretty well with KING in relatively tight ranges. I actually like this kind of trading. I took a nap, and then did some more trading. Yes, it was a good nap...

And so it's October

That's the first post in this section this month, and it's October 10th. I started releasing KING indictors for NinjaTrader 7. Finally. I could have done this in September, but had to deal with a nasty loser (I kid you not) who wasted at least 2 weeks of my time. Not surprisingly, the loser turned out to be another vendor who tried to hurt my business. That's not the first time one of those people tries to do so, but they will definitely not like it when I finally start responding. I developed the indicators myself, which means I had to learn how to program in C#, but that was actually something I like to do, so I don't complain. Don't expect me to post here a lot as I am now starting to work on indicators for Multicharts, so this will keep me busy a bit. Plus, I am really taking a break from selling here, so any selling will be limited to my current clients.

Slow Friday

Another Friday, September 16th, and it was pretty boring, so only 6 trades. Last night I sent out some more information about KING indicators for NinjaTrader 7. Stay tuned for still more, when I am ready to start distributing them. I am going to take a break from my selling activity after September 25, probably for at least 2 months, so these are the last days to get KING for only $1000 because when I am back to selling it, the price will be $1200, or the regular price of KING. You can also get your NinjaTrader 7 indicators much cheaper if you order KING now.

Ending the week

That means this is Friday, September 9th, and that's the sixth trading day in a row. I could go on like that for a while, but I may take a break now. At least from posting here.

Another 5

On September 8th, Thursday, the day we switched to a new contract, the December one. That's another five trading days in a row, or a full week, the ninth this year.

Another 10

This time on September 7th and it was pretty early, at least for me. All these 10 trades took about 30 minutes, more or less, pretty much as long as the day before.

Too good to be true, eh?

So are your results too good to be true? Why not? What's wrong with you? What are you are one of those stinking mediocrities? Don't be. That's only for people with low self-esteem. You can do better than that. You may need KING for that, though. Yet another good day, September 6th, right after the Labor Day. Less than half an hour of action, more than half a grand in profits. You see, trading it's not that hard. It all boils down to luck. You either get lucky or not, but knowing how to get lucky more often than not is what separates winners from losers. With KING, you are much more likely to get lucky than not, as you can see from all those screenshots here.

Back to normal

On September 2nd, which means that the time stamps are again UTC-5 (same as EST) and not UTC-4 as was the case in the last two or three screenshots. All's well that ends well.

Good start in September

It's September 1st, but the results are not stamped with the EST, which is UTC-5, but with the time that is UTC-4. That means that 15:30 was actually 14:30 EST. That might have been so also yesterday and perhaps on one or two other recent occasions in August; I don't have time to check it now. My computer clock somehow did not keep the right time, it was off by one hour. Strange, but that can happen from time to time. I am not sure how much I can trust my computer clock now, could have been off more often, will have to keep checking it more frequently. I was not trading a lot in August, being busy working on custom KING indicators for NinjaTrader 7, so I was not paying close attention. Just as I was writing this, a brief earthquake shook my apartment. Gee, what a day.

12 is a new 10

I first took 10 trades today, August 31st and all that took only 30 minutes. I thought that would be it, but then I spotted a good trade that I even recently wrote about in a new KING document. It's a trade that could give you a 10-pointer easily and indeed that was the case this time as well and it took only a minute for this to materialize. And then I added yet another trade. So that's the story, which I am writing basically to let you know that I am still alive. I am working on custom indicators for NinjaTrader 7 and I hope to post a few demo screenshots this week and the KING owners will get some more info about it in the next few days as well. So stay tuned, everybody. That's the eight screenshot posted here this month. I am not sure how many I will post next one as I will surely be busy with the NT indicators. The time stamps are UTC-4; see the screenshot from September 1st to learn why, above.

10 again

And a similar result as the last time, except that this one comes from August 22nd. The more results I post here, the more terrified some people are. Well, you just can't help everyone. You have plenty of choice out there, folks. Most vendors show no results or show results achieved in hindsight (meaning a theoretical kind of results that were not recorded in real time trading), so you can go for that. I believe that my results are better, but some people are really not as much interested in making money trading as they are in making sure that trading meets their preconceived ideas, the ideas that usually don't require them to leave their comfort zone. So, yes, you've got the choice even though my ideas are definitely better because how else could you explain all these results? (The time stamps here may not be EST, see the entry on September 1st, above).

Another "lucky" 10

On August 18th, but I am posting this basically to let you know that I am alive and kicking. I am working on KING indicators for NinjaTrader 7. I plan to release them in the first half of September, so pretty soon. I will post a few pictures of them next week, so stay tuned for more. They are an improvement over the indicators for NinjaTrader 6.5, so I hope you will enjoy them. Those who don't own KING yet, now may be a good time to buy it. Actually, it's always a good time to buy it as long as you are serious about trading emini futures, but considering its reduced price and those new cool NinjaTrader indicators, now it's a particularly good time for that.

Twenty minutes in a volatile market

And the day was August 9th. Notice that none of those trades took even a whole minute, in fact, not even 45 seconds. The eight of them did not last even 15 seconds, and one of them took just 1 second, and that's probably a new record. I was shooting for 6 ticks, adjusting to more or less depending on the momentum. Indeed, it was very much pure momentum trading. That's yet another full week of results.

Great volatility, great results

That was courtesy of Standard and Poor that downgraded the US debt. Yep, that's the same agency that missed the mortgage problem and so now they are very proactive. Just another bunch of overrated finance guys with big egos who are always either too late or too soon, which would make them really lousy traders. That took place on August 8th, and it was a day when the market was trending very nicely, not to mention that it dropped over 600 points too compared to the close last Friday.

250!

That happened on August 5th, 2011, a few months short of three years of pretty continuous posting in this section ("I can do it do!"), although I was posting rather sporadically in 2008 and early 2009. The market was crazy, so I decided to abstain from participating in this madness after taking a few trades. It was quite volatile yesterday, but today it felt even more so. Yesterday, YM dropped about 500 points, but that took many hours, today it dropped about 400 points from the open in less than 3 hours! I saw a few 60-70 tick 1-minute bars. The last time I can recall things like that was in the volatile days of 2008. Anyway, it's a Friday, so not the best day to trade, but a good one to celebrate the 250th screenshot of my daily results...

An early bird treat...

There are angry birds, and then there still are early birds. I am neither. I just woke up early because I did not sleep well and decided to go back to bed after testing my trading skills once again. The market was quite volatile so it was possible to get to $500 in less than 40 minutes and some of the trades took less than a minute. That's reporting from August 4th. I took some more trades after a refreshing nap, but that's a different story.

And then a tragedy strikes...

Let's just say that I could not come up with a better headline for this screenshot that comes from August 3rd. But I could also use "all's well that ends well" in this case. I lost quite a bit on one trade, but that was because I underestimated volatility of the market and was not paying close attention to what was going on. If I were, I would have added to my position ending up with yet another win. But things happen. I don't expect to post a lot this month as I will be busy working on KING indicators for NT7, but I do hope to post at least 5 more screenshots like the one above.

Double perfection

That's because 12 is twice 6, and 6 is the first perfect number. Seriously. I was holding that last long for a while as I was convinced that the bottom was just there and the market was bound to rise, which it did. And then I took another short (I was shorting most of the day), as I was expecting the market to drop there, and under most normal circumstances it would have been a 10-15 ticks drop, but since the session was almost up, I decided to go for 5 ticks only. But the market still managed to drop 20 ticks from my entry. This Monday, July 25th, ends yet another full week of results, the second such a week this month.

Fibonacci Friday

No, I don't use Fibs for my trading. They are about as useful as Elliot waves in my opinion, that is, they look really great in hindsight. But 8 is a Fibonacci number, and since I took 8 trades this Friday, July 22nd, that explains the headline. I am showing all of them as they can be of some educational value to KING students. Notice that the first trade took about 45 minutes, but I thought I was right about sticking to my position because the 5 minute chart was telling me to do so. In fact, the 5 minute chart was telling me to short it even harder, but I kept waiting for a good pullback, which never happened. And indeed the market then moved down and so I took a few more shorts. I switched to the long bias after the price jumped over an important line on a strong bar that showed a PE signal. The 5 minute chart was suggesting that the reversal took place as well because of some characteristic bar that I talk about in the KING course. See, successful trading is not really about pure guessing, but analyzing what the market is telling you. That's just one more example of it. You too can do it well.

I took a hit

It was one of those Thursdays that feel like Fridays, and that often spells a trouble when you are trading. So was this time, July 21st. I think I was chasing the market a bit, but still that fast adverse move against my position came quite unexpected and its magnitude took me by surprise. I tried to adjust my stop-loss, but the move was too fast and I ended up with a big loss that took me from a bit over $400 to a small hole in the PL balance. But it was not the end of the day, so I got out of it, in part due to betting a bit more than usual on the trade that followed the big loser.

7 is a new 10

It was a pretty slow day, so I got bored and stopped trading earlier. That's also the 7th screenshot this month, I may post one or two more in July, but probably not more. That happened on July 20th.

Round, very round...

And I almost ran out of the daily session. That took place on July 19th.

You greedy pig, you...

That would be me. The pig, that is. Surprisingly, this also happened on a Monday, July 11th. Mondays don't have the best of reputations. These are days when the enslaved masses head back to work to meet their bosses who are pissed too because they have to see those lazy, whining bums again. It's a lose-lose situation. So I don't trade a lot on Mondays in solidarity with the enslaved masses and their bosses. Or maybe because I tend to be sleepy on Mondays. I think I like the solidarity explanation better. Today completes yet another full week of trading results. The sixth this year. Perhaps it's time for a break.

Lovely Friday...

I can't believe I am saying this ("lovely Friday," that is), but that's true. Some Fridays can be just awesome. Of course, you don't want to work too hard on Fridays, and so I only spent about 50 minutes (a bit less than that, actually) to collect nearly $600, which amounts to about 11-12 bucks a minute, which beats the minimum wage by quite a margin. And all that happened on July 8th.

240!

This is the 240th screenshot with daily results that I have posted here. It comes from July 7th. I hope to reach 250, but I am not sure if I will continue posting beyond this number. My trading business is expanding in ways that I think will be much more profitable than what I would ever be able to make from my vendor business, and so I plan to focus on others things in the months to come, especially in 2012. But I intend to market KING at least till the end of 2011.

Long live long trades!

The last trade would have been an easy 20-pointer, which means that my entry was not totally accidental. I tend to trade on the short side, but that does not mean that I am oblivious to good long opportunities. The next to last trade would have been an easy 10-pointer, it was one of those trades that I like to refer to as BYH (Bet Your House) trades, but since it deteriorated a bit over time, I was a bit conservative with my target. Well, so that's another good day, July 6th.

The first day in July

That would be July 5th, the day after the long holiday. It started slow, at least to me, but ended up with 4 trades that did not take even a whole minute. Two of these beauties are shown above.

The last this month

And the tenth for the month of June. I like to post here 5-10 shots like that every month, and sometimes it's even more than that. Today is June 28th.

Yet another good Monday

A week later, June 27th. Mondays can be challenging, so I don't tend to trade on Mondays as much as on other days, but that depends on other things too. I can have very good Mondays too.

One more

From Monday, June 20th, the 6th day in a row. It may be the last post here in June. The market was rather slow, even though the last trade was very quick, so I got bored and decided to stop after $200.

Yet another full week

Which ends Friday, June 17th. Fridays are not my favorite trading days, but I somehow managed to produce 8 solid trades. This week I was trading using just one chart, the main chart of KING, so as you see, it's possible to do it from one chart only. It's largely a matter of training (as those who own KING know very well, I like to stress how important this is), but I do believe that the other charts can also help with your trading decisions.

Yet another good one

From June 16th. A rather boring day, but good, nevertheless.

$10 per minute

Well, nearly 10 bucks a minute: pretty much 60 minutes of trading and nearly 600 bucks. Notice that 6 out of these 10 trades did not take even a minute, the shortest lasted just 6 seconds. That's not unusual for KING trading on days of good volatility like today, June 15th. The trades were very much along the lines of classic KING trading, so I show them in their full glory.

Late day trading

On June 14th, so only 5 trades, but with a slighter larger number of contracts per position.

Not a bad day...

Another day in June, June 13th. I don't think I will be posting much here this month, but that's the third post in June, anyway, and 230th overall since late 2008 when I started posting here. It is a summer time, after all, so I deserve a bit of a break, don't you think so? Plus, I have recently been contacted by some hedge fund and I am now busier than ever. Still, I hope to continue selling KING until the end of 2012, but probably not beyond that date.

Ending up with a quickie

Just 6 trades and the last one took only 6 seconds. Almost exactly 40 minutes of trading. That's all for June 2nd.

Another easy day

Which happens to be the International Children's Day in many countries of the world, most of them of the former Soviet block, June 1st. In many other countries, the children's day is observed on some other days. Unfortunately, the US does not have a firmly established nationwide tradition of celebrating this day. Too bad, I think American kids deserve better than that. So, just 5 trades today, about 30 minutes of action and almost $300 in profits. Child's play... I could have scored much better today, but then again, there is still another day, and then another, and another... There will always be plenty of opportunities to extract money from that perennial loser, Mr. Market. At least, for a KING trader.

Just another "lucky" seven

And the day was May 19th, another good Thursday. That's the eight screenshot with trading results this month, if I am not mistaken. The last trade took a whopping 11 seconds. Slow day or something ...

Los neatos or las neatas?

One way or another, it's just seven beauties in a row with only 2 contracts per position. Two of these trades did not take even a whole minute. That's a score report from May 16th.

A good loss

A good loss is not bad, although it's better to avoid one. Yet sometimes you just need to take it. It's safer. But when a loss is a good one? When you can learn something from it. I keep my stops relatively wide, but in this case I made a mistake of adjusting the stop-loss to 2 ticks below the most recent pivot, instead of keeping it at 15 ticks from the entry. And guess what? It got hit on the lowest tick in this pullback and then the market moved up again, just as I anticipated. The lesson from it is this: don't be penny wise and pound foolish, for trying to save one tick may cost you many more. But there is another thing you can learn from a sizable loss like this one, and that's something I have mentioned here before, the last time in the past few days, namely that a loss like that tells you that volatility is good, probably greater than you thought it was and so you can still compensate for it. That was also the case today, May 10th, when after that loss I found myself in a hole of negative 40 bucks or so, but got out of it in the 6 trades that followed and still closed above $200. That's the 6th trading day in a row. I did not plan this post, and I doubt I will continue posting more this month unless I have something interesting to say.

Another full week

The 5th day in a row, so it completes another whole week. Today is May 9th, Monday, and as much as I hate Mondays, I think I did okay. Most trades featured here are pretty much by the book, so this screenshot can also serve as an educational tool, which is why I show it in its full glory.

Back to normal

The end of the week, and I was a bit fatigued. So that's it for May 6th. I will probably post only one more shot this month for the total of 5 and will most likely stick to posting 5 per month. I have more important and urgent things on my agenda.

So I had a loss ...

Yeah, I did. Big freaking deal! What, a guy can't have a loss once in a while, anymore? Volatility was excellent again today, May 5th, and when volatility is that good you can take quite a few trades quite easily. On days like that, Mr. Market practically eats from your hand, and yes, sometimes the bastard also bites. That bad loss put me in a hole for the day, but it also told me that volatility was better than I expected, which meant that I still had a chance to crawl out of this hole. I do have a longer version of this, Mr. Trump, but it's probably longer than President Obama's long version of the thing, so I won't release it unless Ivanka makes a big fuss about it.

I apologize ...

Yes, I do apologize for this obscenity. It won't happen again. But it was a very good day, May 4th, volatility was great and I was in a splendid mood, so as you see one day you may feel like a loser, and the next one not so much. My only regret is that I did not go for 10 points on the last trade as the potential was there and you could have scored even 20 points. Yes, I have a long version that lists all the 20 trades, but I won't release it unless Donald Trump personally demands it. Don't expect many posts here this month, as I am going to be busy, working on the KING indicators for Tradestation among many other things.

I feel like a loser ...

The last 3 trades should have all been 5 pointers. Heck, they could have even been 10 pointers! So what happened? I was not in the best shape mentally, kinda drowsy, so I was just too timid. But what a heck, another good trading session overall, this time on May 3rd. With the exception of the maverick long, all other trades are pretty much by the book, that is going with a trend as this is a preferred way of trading with KING.

Lucky 13

That's the 13th screenshot this month, if I am not mistaken. I may not post any more this month, and I usually don't get over 10 per month, but from time to time, I may shoot for more. Today is April 27th.

Another perfect ten?

Sort of, although I have used 2-5 contracts per position, so it was not a classic 1-3 contract KING trading. Actually, 2 contracts is now my basic opening position. That took place on April 26th. Still scared of being that good? Yeah, most people just want to be average. The problem with this is you cannot make money in this field by trying to be just average. You have to be better than Joe Schmoe. I have been quite busy lately, and because of that this site is not being updated as often as in the past, but this state of affairs will not last forever.

Another example of classic KING trading

That's pretty suitable for educational purposes. And all that happened in a small range of only 15 ticks on April 20th.

Late day trading

In the last 45 minutes of the daily session on April 19th. I used 2-4 contracts per position, meaning the basic position was 2 contracts.

Another lucky 7

If you believe that luck had anything to do with it. Not that there is anything wrong with it. Today is April 13th, so it was also a lucky 13.

Just another day

The 8th in a row. Started rather late and ended just 30 seconds before the end of the daily session on April 12th. Well, had I waited another 20-25 seconds that would have been a 10 pointer. Bad luck. Sometimes I exit my position sooner than I may have originally planned when I am not sure if 10 ticks is possible and then I come to regret it, but this time I really had very little time left.

Better than a perfect ten

I am showing all the trades as they can be useful for educational purposes. They were pretty much by the book, although since KING is a discretionary methodology, your entries and exits might have been somewhat different. The point is that they were accomplished using KING ideas and indicators, and if you own KING you must agree that these were really sound KING trades. They come from April 11th, the seventh consecutive day of trading results I have posted here recently. Question: do you really think that this kind of trading would be possible with a bunch of random indicators or other stuff that often borders on ludicrous or, in other words, the regular stuff offered on the Internet that almost every dummie and his grandma loses money with? If your answer is no, you are smart enough to give KING a whirl.

The sixth day in a row

Another Friday, April 8th. I could go on like that for a longer while, but then again so could you if you spent some time with KING. I hear time and again from my clients that they make progress and are satisfied with it or that they have excellent results with KING. I am talking about people who 6-12 months ago were total newbies to trading emini markets. And then there are those who think that it's enough to buy something and the rest is easy. Actually, it's the way around. Buying stuff is easy, putting it to good use takes time and effort. Except that there is a very big difference between buying KING and buying anything else of this kind. The difference is that with KING, as you can see here and in many other pages of this site, putting in the time and effort pays off.

Yet another full week

This one started last Friday, April 1st, ends today, Thursday, April 7th. That's the third full week of results this year. The next to last trade could have been a 5 or even 10 pointer and while the 5 minute chart was suggesting a strong move up in the making (which indeed happened), the 1 minute chart was much less certain about the prospects of this trade, so I exited it with only 2 ticks of profit. Well, no big deal, a sure profit is better than an expected one.

Narrow range

This result comes from a range of less than 25 ticks. Not bad, but on two occasions I had to abort my position with only 2 ticks of profit. That's another April day, the 6th. I don't know how much I will be posting here this month because I am pretty busy with other KING related things, but a few more screenshots are still likely to come here this month.

Slow day, kinda

It was slow at first after a strong move up during the first two hours or so, so it took me 11 trades to get a solid 200 bucks. That's about it for today, April 5th.

Early bird's treat

I got up before the opening of the daily session today, which is like very early for me. It must be an old age or something. Research shows that older people (the old-fartish bracket) require less sleep than younger ones. Well, on the other hand I used to get up pretty early when I was a teenager (school is a bitch, you know), so why not look at the bright side and see it as a sign of rejuvenation. Anyway, I recently released KING 2.0 and the number of new buyers has been staggering so far. Just kidding. I know, you folks are waiting for the real price, like $1500, not some paltry $1000. Yeah, I too think that $1000 is totally insulting to me and KING, but well, I like to offer a discount from time to time. Must be an old age or something, too. I started working on indicators for Multicharts and Tradestation, so I hope to have them ready this half of 2011. Today is April 4th, and the market was pretty slow. It's starting to take off now, when I am posting this. Well, whatever, I think I am done for the day, anyway.

April Fools' Day trading

Yes, today is April 1st, and all these trades are pretty much by the book. For the first trade I was consulting a 5 minute chart, but all other trades did not really require it. The first trade was also motivated by a FB forming about the time the trade was placed. Notice that my first short pretty much triggered the big slide that followed soon. Talk about the power of KING. Not all my trades are always by the book, so a KING newbie might find them hard to understand, but after 9 years of trading eminis, I am a much more intuitive trader than those who start trading KING and my trading style is not that of the beginner. For these reasons, the trades I post here are not meant for educational purposes, unless I clearly state that they can be. Those above can be used for KING education. If you are new to KING, you obviously want to trade by the book, but your trading style is bound to evolve too. It's important though you start from sound trading ideas and KING ideas are sound. Of course, I use the same charts and indicators that any KING owner has access to as well.

Good enough

Yet another day, March 15th, just a week or two before the release of the second edition of KING. So stay tuned.

New contract

But results as usual. The majority of retail traders switch to a new contract on a rollover Thursday most of the time, but if you don't do so (because you forgot or have a more sophisticated reason), you are unlikely to be affected big time the first two days unless you trade bigger size (10-20 contracts). Then a post-rollover Friday may seem like lacking in volume. And it gets progressively worse the further away you are from the rollover day. Eventually, a week from the rollover day, the trading in the old contract stops. Today is March 14th.

Another full week

Today is Friday, March 11th, the end of yet another trading week. The screenshot above is the fifth from this week, so it completes yet another full week of trading results. I used a somewhat bigger size (4-6 contracts) in most trades today, and that's what I plan to do in future too, when I am done with selling KING. I then will trade just 4-6 days a month, with perhaps as many as 5-25 contracts per position. These days I trade 10-15 days a month. Not that often, but that's enough for me. If you are new to trading, you should trade at least 15 days a month, the more often, the better.

200 bucks in 10 minutes?

Well, more precisely $199. Form 13:25 to 13:35 EST. I really did not realize that it took only 10 minutes for that. But if volatility is really good, that's what's possible with KING. I then added one more trade to cross $200. Notice that 5 out of these 8 trades did not take even a whole minute each. Again, not so unusual for KING on the days of really good volatility. But that's not all, because one of them took just 2 seconds! It's the third from the top on this list. That must be a new record or something. Today is March 10th.

202

Some days can be better than other, but it usually takes 10 trades or more to get over $500. And sometimes volatility is not good enough for that, too. Still $200-300 with a modest number of contracts (usually 1-3) is not that bad, either. Today is March 9th.

201

One more, from the day that follows the historic day of 200, that is from March 8th. It's okay to make $200 a day. You want more? Sometimes you just can't get it. I also started trading late, two hours before the session end, but that's pretty normal for me.

200!

And today is March 7th. That's the 200th screenshot of my daily results posted here since I launched KING. I thought that 222 was a good number for the occasion and I am too busy with other things to trade much these days, so that had to be it. Now, 200 is also a number of copies of KING I intend to sell, there are only about 60 left, and I definitely don't intend to keep selling it beyond 2012. The price is now $1200, but the last 10-20 copies will be sold at $1500 or so. You may want to keep it in mind when planning your purchase. That's still a buyers market, but with 10-20 copies to go, it will be a seller's market. Remember, at some point KING was only $700, so yes, it can also be $1500.

199

Finishing in the KING's style: the last two trades did not take even a whole minute each. And that took place on March 3rd, another good day for KING. Like most, anyway.

198

Let the countdown begin. To 200. That's the 198th screenshot with my daily results posted in this section counting from very late 2008. The day, February 24th, started with a pretty bad loss due to my sloppiness, but at least that told me that volatility was good. And when volatility is good, a loss like that is hardly a disaster. And, as you can see, what followed was 12 perfect trades. Picture perfect. See, that's the power of KING. If you think that KING is just a bunch of random indicators, well, you are dead wrong. It's still not too late to jump on KING's bandwagon. Not late at all. But a year from now, it may be too late, and then we will bury you!

Classical lucky 7

Yes, luck is important in life, in trading as well. But luck always favors the prepared mind, so I really don't recommend that you launch your trading career without proper preparation. I think KING is a good way to get prepared. And not that expansive, either. Certainly, not when compared to what you stand to lose if you are not prepared. Today is February 22, and this is the 197th screenshot posted in this section ("I can do it too!") ever since I launched KING. Very close to 200. And yes, I keep working on the second edition of KING, so this memo is pretty much to let you know that I am still alive and even kicking.

Sesquiroundness

Yes, that's a new word that I probably just coined. And it makes perfect sense here: 240 is perfectly round, 5 is half-round, so what we get in total is something that is one a and half round. Well, I am not much of a marketer (or, more precisely, I suck as a marketer), but even I know that with a name that cool ("sesquiroundness") 240 suddenly looks more like 300. Okay, so today is February 15th, and I am working on Version 2 of KING. And it's boring, people! Really boring. Seriously, how many more KING documents can I write? There are like over 50 in the KING body already. So you expect me to write even more? Well, that's what I am doing. But mostly, this version will be about updates and revisions of the core of KING than new ideas. I hope to deliver it in March. Yes, this March.

I like 6

6 is good. It's also the first perfect number. You know what the next perfect number is? 28. And today is February 10th. I am busy working on the second edition of KING, so I am not posting here very often. I am also not updating this site too frequently these days, but once Version 2 is released this is likely to change. Still, we are only 5 screenshots (like the one above and many below) from the 200th screenshot with my daily results, so it's nor like I have not posted here a lot, anyway.

So... it's February

The first day of February, and I am not sure why I am so stuck on 8. The number of trades, that is, but that's just the way it sometimes is. The last trade was only 16 seconds, and overall I used only 1-3 contracts per position with the exception of one situation, where I used 4 of them, so that's pretty much what I call "classic KING trading," by which I mean trading with 1-3 contracts to make $200 or more a day. I released 10 new videos just yesterday, available to those who own KING, and in the next few weeks, I will release a new version of KING. Unless something really bad happens, not that I am planning or looking forward to something like that. I may not be posting a lot here this month because of my work on the new version of KING, but then again, I said the same in January and ended up with 13 screenshots here, if I remember it correctly.

End of the week

And another classic example of KING trading, $200 or better with 1-3 contracts, this time in under an hour. Incidentally, this is the 6th trading day in a row, more than a whole trading week. Yes, I could have traded longer today, but I have other things to tend to, so that's just it. Notice that the 3 out of these 8 trades did not last even a whole minute! I just posted a bunch of new KING videos on YouTube, all 5 of them, in fact, that I hope the fans of The Hitchhiker's Guide to the Galaxy will especially like. Here are the links to them (in future I will embed them on this site):

Emini Trading Success - NinjaTrader & KING - 1

Emini Trading Success - NinjaTrader & KING - 2

Emini Trading Success - NinjaTrader & KING - 3

Emini Trading Success - NinjaTrader & KING - 4

Emini Trading Success - NinjaTrader & KING - 5

An "I am running out of good headlines"

headline

And all happened on January 27th. Yep, another good day. How boring... Don't worry, tomorrow is a Friday, so I may not trade and even if I do, I may not post here.

Classic KING trading

Meaning, 1-3 contracts, $200 or better. One of the trades did not last even a whole minute. Actually, only 12 seconds. That's another classic feature of KING. That's the one next to the last trade on the list above. And all that took place on January 26th.

190!

190 is the number of screenshots posted on this site that show my daily results accomplished using KING ideas. Yes, that's very close to 200. I think we will reach 200 this year for sure. I thought I would stop posting here at 100, but I may stop at 200. Or not, but those who have what it takes to succeed at emini trading had plenty of evidence that KING works at 100, those who don't will not be convinced even if I posted here 1000 of screenshots, which is unlikely to happen. This is also the 10th screenshot with results from January, but two of them are a bit hidden (there are links to them, though). So that's yet another memo, this one from January 25th.

Lucky 8

I think that 7 definitely gets way too much credit for being a lucky number. With KING almost any number of trades can be "lucky," but luck, while a desirable thing in its own right as long as it is good, is not what determines whether you make money day trading or not. It's the skill, it's the methodology that do and that's what KING provides. As simple as that, although still too complicated for many. And that's the memo from January 24th. I am releasing 10 more educational KING videos this month, so stay tuned if you are a KING owner. If you are not, I think you should seriously talk to your shrink.

Just one more this week

That would be the third week of January, and the day is Friday, 21st. Not a bad day at all. I had two really quick trades today. One of them did not last even 5 seconds (see the screenshot right below), the other was also less than a minute in duration (30 seconds to be more precise).

Two quick trades

from 1-21-01

Annoyed...

Or more like pissed off. See, I thought the next to last trade would be a 10-pointer. And it would have been, but I lost my patience and exited with 5 ticks only. When the target of 10 ticks was hit eventually, I got pissed off and decided to take revenge. After all, that sleazy bastard, Mr. Market, just deprived me of 5 ticks! Not particularly smart, but the potential for profit was still there or so I thought. And I exited with 5 ticks again. Not bad, but this entry would have been good not just for 10 but even for 20 ticks! Well, the moral of this story is that the trader is always the weakest link. Which is why no one can guarantee you anything, but as you can see from my today's results (not to mention dozens of many other items of this kind posted here), you can be sure that KING is a sound trading methodology. Today is January 19th, another sunny day in Southern California, and I am posting this basically to let you know that I am fairly alive and working on Version 2 of KING. This month I will release 10 more videos, and in a few more weeks the whole package.

One more day this week

And it's better than yesterday, which means that I am talking about January 13th. Not a bad day at all. Three days like that could easily pay for your copy of KING.

Another day in January

This screenshot comes from January 12th. As I said before, I will be posting here rather sporadically, at least for the first few weeks (months) of 2011, as I am very busy with other things, but then again, there are over 180 screenshots like that in "I can do it too!" sections and about 30 more that belong to Katherine, the first KING graduate, so there is plenty of evidence that KING is a sound methodology. Well, at least plenty for those who think they have what it takes to succeed in this business. And that's pretty much what it takes to succeed at many other businesses.

Good days are back!

Or I am back in the groove... whatever that means. In this case it means like $200 or more in about an hour or less with 1-3 contracts per position and all this is just classic KING trading. Notice also that one of those trades (the fourth one) did not last even 30 seconds! Yes, when volatility is good, results like that are quite possible. Well, it takes time to be that good, but even if you were to average only one third of it a day (meaning $70 or so) then the current price of KING is quite fair and certainly so if compared to its competition. And while I don't claim to be a miracle maker, I do think it's very safe to say that my trading methods are as good as those offered for thousands of dollars more, so if you think that KING is expensive at $1000, you may want to keep a bigger picture in mind. And let us not forget that KING's price is likely to hit $1500 within a year or so, and it's almost guaranteed to hit $1300 this year. And that memo is from Friday, January 7th.

Another good week

Well, the first week of 2011 is not over yet as today is only Thursday January 6th, but I don't think that tomorrow will alter that picture much if at all. Yes, I traded more than just one day this week (see here and here if you don't believe me), but being busy with other things I did not post here and until Version 2 of KING is released I am afraid I will not be posting in this section more often than once a week or so. And it's a much better week than those in December were, although I traded sparsely then, in part because the market was pretty slow and not much fun to deal with as these two screenshots that I did not even bother to post in December can remind you of. But the times of major holidays are known to be slow times. Fortunately, they don't happen that often. I heard from Keven again, right before the New Year, his success with KING continues, not surprisingly to me considering his attitude ("I'm my 'own man'").